Battery Revenue

Optimization

Platform

Industry leaders count on Enerheads:

To ensure optimal BESS performance,

one must place at least one bid every 6 minutes.

With multiple active markets and multiple assets, this cannot be done only manually.

Ensure long-term profitability accessing all available reserve and energy markets

FCR

Frequency Containment Reserve – the primary (fastest response) balancing reserve. First aid kit for correcting system frequency that requires a super quick 30 second ramp-up.

aFRR

Automatic Frequency Restoration Reserve or secondary balancing reserve is procured in both reserve and energy markets and requires a 5-minute ramp-up.

mFRR

Manual Frequency Restoration Reserve or tertiary balancing reserve is procured in both reserve and energy markets. It requires a 15-minute ramp-up and hence can be activated manually.

Intraday

A fast-paced on-the-day energy market used to correct the Day-ahead predictions.

Day-ahead

A primary wholesale market where energy is traded based on consumption and generation forecasts for the coming day.

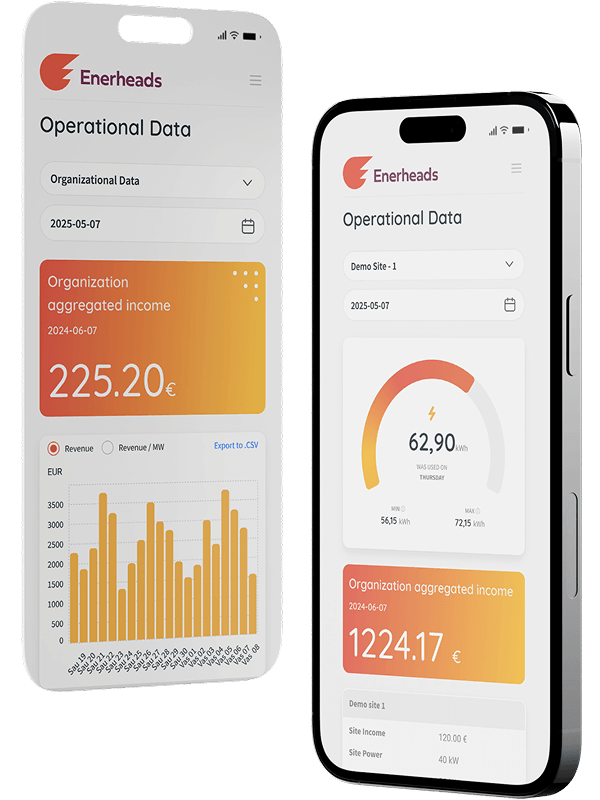

Witness the battery action in our demo

See how your battery can do more than just store energy. With Enerheads, you gain real-time access to all key reserve and energy markets — from ultra-fast FCR (30-second response) and aFRR (5-minute ramp-up) to mFRR (15-minute manual activation), as well as Intraday and Day-ahead trading. Our platform optimizes dispatch automatically, helping you capture every revenue opportunity while supporting grid stability. Track performance, income, and market participation live — so you can make data-driven decisions that maximize long-term profitability.

We do more to maximize your

project profitability

Both automated and hands-on trading

We leverage AI and advanced data analysis to craft optimal trading strategies, but we know some market situations can’t be modeled. These high-risk, high-reward moments are where our experienced energy traders step in to seize opportunities and avoid pitfalls.

Advanced trading risk assessment

At every step, we use probability density functions instead of discrete values. While more complex, this gives a fuller view of potential bids and outcomes, helping us weigh risks and rewards to minimize losses and maximize gains.

Keep up to date with the dynamic energy markets

Your project’s profitability depends on energy markets, so staying informed is key. We provide monthly analyses with market insights and tailored advice — from adapting to regulations to upgrading equipment or renegotiating warranties — to ensure long-term portfolio success.

The team you can rely on

Andrius Džiaugys

Eimantas Galkevičius

Liudas Karalius

Nerijus Juškaitis

Narimantas Bloznelis

Rokas Zaveckas

Justas Kvedaravičius

Emilija Zlatkutė

Justas Nečionis

Stay up-to-date

with industry news

/

/

Enerheads has signed a cooperation agreement with Future Energy, UAB to optimize a 56 MW stand-alone Battery Energy Storage System (BESS) in Raseiniai, Lithuania. The…

/

/

Our latest analysis suggests that the Frequency Containment Reserve (FCR) buildout in the Baltic markets will likely be completed by mid-2026 at the latest. The…

/

/

Enerheads has signed a cooperation agreement with Arvilsa, UAB to optimize a 43 MW stand-alone Battery Energy Storage System (BESS) in Tauragė, Lithuania. Scheduled to…

/

/

Enerheads has signed a cooperation agreement with Future Energy, UAB to optimize a 56 MW stand-alone Battery Energy Storage System (BESS) in Raseiniai, Lithuania. The…

/

/

Our latest analysis suggests that the Frequency Containment Reserve (FCR) buildout in the Baltic markets will likely be completed by mid-2026 at the latest. The…

/

/

Enerheads has signed a cooperation agreement with Arvilsa, UAB to optimize a 43 MW stand-alone Battery Energy Storage System (BESS) in Tauragė, Lithuania. Scheduled to…